NY C-11 2017-2024 free printable template

Show details

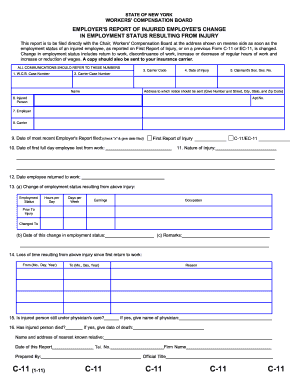

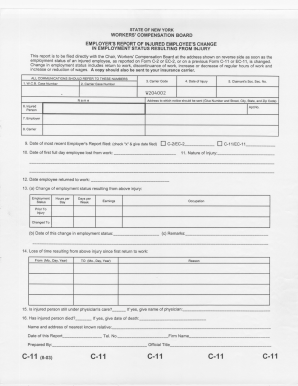

C11EMPLOYER'S REPORT OF INJURED EMPLOYEE'S CHANGE

IN EMPLOYMENT STATUS RESULTING FROM INJURY

PO Box 5205, Binghamton, NY 139025205

Fax #: (877)5330337 l Web Upload Link: https://wcbdoc.xrxfs.com/login.aspxlEmail

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your c 11 form 2017-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your c 11 form 2017-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing c 11 form online

To use the professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit workers comp c11 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

NY C-11 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out c 11 form 2017-2024

How to fill out c 11 form:

01

Start by reading the instructions provided with the c 11 form.

02

Gather all necessary information and supporting documents required for filling out the form.

03

Begin by providing your personal information in the designated sections of the form, such as name, address, and contact details.

04

Carefully fill out each section of the form, ensuring accuracy and completeness.

05

If applicable, provide any additional information or explanations requested on the form.

06

Review the completed form to verify that all information is correct and no sections have been missed.

07

Sign and date the form in the appropriate sections.

08

Submit the completed form as instructed, whether it is by mailing it, submitting it online, or delivering it in person.

Who needs c 11 form:

01

The c 11 form is typically required by individuals who are applying for a specific purpose or benefit that necessitates the completion of this particular form.

02

This form may be needed by individuals who are seeking to apply for immigration-related matters, such as obtaining or renewing a visa or seeking a change in immigration status.

03

Additionally, the c 11 form may be required by individuals who need to provide specific information to government agencies or authorities for various purposes.

Please note that the specific requirements for who needs the c 11 form may vary depending on the jurisdiction and the purpose for which the form is being used. It is important to consult the relevant authorities or agencies to determine if the c 11 form is required in your specific situation.

Video instructions and help with filling out and completing c 11 form

Instructions and Help about c 11 form workers comp

Fill ny c 11 form : Try Risk Free

People Also Ask about c 11 form

How long does employee have to report injury in NY?

Who is exempt from workers compensation in NY?

Do members of an LLC need workers comp in NY?

Do I need workers comp insurance for myself in NY?

What is Section 11 of the New York Workers Compensation Law?

Who is exempt from workers compensation insurance in NY?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is c 11 form?

C 11 form is a form used by employers in Ontario to collect information from their employees for the purpose of calculating the Ontario Health Premium. It is used to determine the amount of the premium, if any, to be deducted from an employee's pay.

Who is required to file c 11 form?

A C-11 form is used by certain employers to report taxes withheld from employees, including federal income taxes, Social Security taxes, and Medicare taxes. All employers who are withholding these taxes from their employees are required to file a C-11 form.

What is the purpose of c 11 form?

The C 11 form is a Canadian tax form used by non-residents of Canada to file their income tax return in Canada. It is used by individuals who are not Canadian residents for tax purposes and who are carrying on business in Canada, or who have rental or other income from Canadian sources. The purpose of the C 11 form is to allow non-residents to report their income to the Canada Revenue Agency and to calculate the amount of taxes they owe.

What information must be reported on c 11 form?

The C 11 form is used to report information related to business tax returns, such as gross receipts, income, deductions, credits, and expenses. It is also used to report information related to payroll taxes, such as wages, tips, and taxes withheld from employees. The form must also include information related to sales and use taxes, such as the amounts collected from customers and the amounts remitted to the appropriate taxing authority.

When is the deadline to file c 11 form in 2023?

The deadline to file C 11 Form in 2023 is April 15, 2024.

What is the penalty for the late filing of c 11 form?

The penalty for the late filing of C 11 form is a fine of up to $1,000. Additionally, the company may also face other penalties, such as suspension or revocation of its license to do business in the state.

How to fill out c 11 form?

1. Complete the top portion of the form, including the name of the taxpayer, their address, and their Social Security Number or Tax Identification Number.

2. On the bottom portion of the form, complete the date of the tax return and check the box for the type of return being filed.

3. Provide the total number of exemptions being claimed on the form.

4. Complete the applicable income section on the form, which includes wages, salaries, tips, bonuses, and any other income.

5. List any deductions or credits being claimed, such as student loan interest, moving expenses, or charitable contributions.

6. Calculate the total tax due based on the income and deductions provided.

7. Sign and date the form and include a payment for the amount due.

8. Mail the form and payment to the address listed on the form.

How can I send c 11 form for eSignature?

When you're ready to share your workers comp c11 form, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute c 11 report form online?

Completing and signing workers compensation c 11 form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I edit c 11 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing new york c11 form.

Fill out your c 11 form 2017-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

C 11 Report Form is not the form you're looking for?Search for another form here.

Keywords relevant to c11 form workers comp

Related to c 11 form instructions

If you believe that this page should be taken down, please follow our DMCA take down process

here

.